Ready to start your training?

About bdtax.com.bd

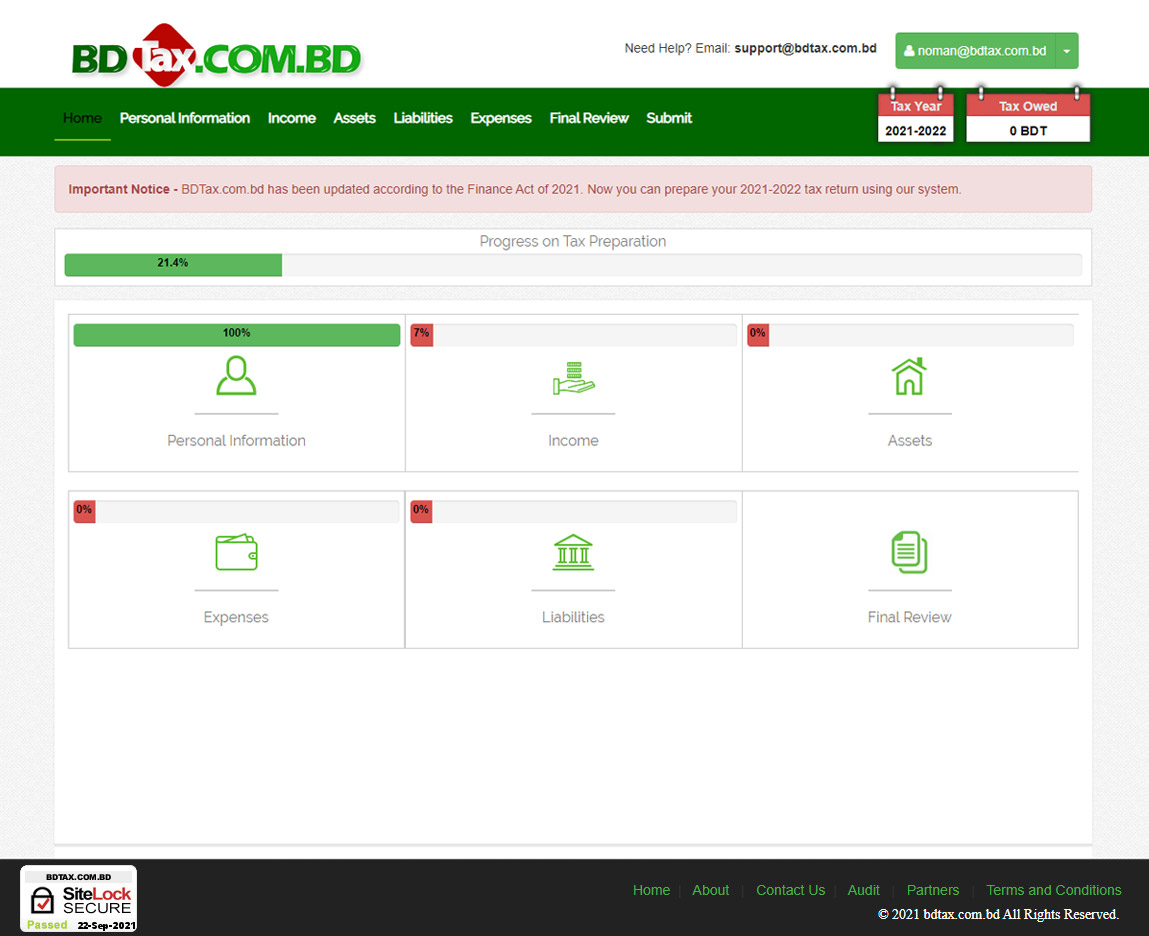

bdtax.com.bd is the first online tax preparation, processing and submission software for Bangladesh. With bdtax.com.bd you can easily prepare your tax, electronically file with the National Board of Revenue (NBR) and pay any tax due with a mobile payment, credit card or bank transfer. It is a system guided easy-to-use tax preparation software that will save you time, money and help you reduce any tax potential audits by the Government. Give it a try today.

Date and Time

Thursday, Nov 06, 2021

Time: 07:00PM to 10:00PM

Online Course

Course Fee: 1000 BDT

Platform: Zoom

Salaried Person Tax Return Preparation

Course Description

This course is designed for the private service holder so that they can easily prepare his tax return for the year 2021. How a salaried person will calculate his tax liability based on his income will be shown practically in this training program. Tax liability calculation after considering the exemptions as per tax law will be discussed using an example.

Tax rebate is most important part in tax liability calculation because tax rebate helps to reduce tax liability significantly of a taxpayer. But to avail the tax rebate, a taxpayer must invest or donate in the certain areas mentioned in the tax law. Otherwise, tax rebate shall not be eligible to claim during tax calculation. You will learn where to invest or donate to avail the tax rebate to reduce tax liability.

And at the last step, you will learn how to prepare a tax return form by salaried person. In this section, you will learn how much assets you should show in the assets, liabilities and expenses statement. Who requires to submit this statement and is there any benefit to show more assets in this statement?

Course Trainer Bio

Jasim Uddin Rasel is a fellow member of Institute of Chartered Accountants of Bangladesh (ICAB). As a tax consultant he assists the company in tax assessment, tax advisory, tax compliance etc.

He gives advice on what a company’s tax plan should be, where it can get the most tax benefits by investing. And, if the company is deprived of benefits after the tax assessment, he also gives advice on what should be the strategy for going to the appeal and tribunal.

In addition to working as a tax consultant, he provides training as an instructor in various corporate houses. He is teaching TAX and VAT at ICAB.

Jasim Uddin Russel’s writings on tax and VAT have been published in Prothom Alo, bdnews24.com and The Financial Express.

His book on tax and VAT has also been published in both Bengali and English.

Learning Outcomes

You will learn practically as discussed in the above which will cover the below issues:

- Taxable Income Calculation from a real-life example

- Investment Allowance and Tax Rebate Calculation

- Where to Invest for Tax Rebate

- Where to Donate for Tax Rebate

- Tax Liability Calculation

- Required Documents Discussion that shall be included with tax return form

- Tax Return Preparation

- Assets, Liabilities and Expenses Statement Preparation